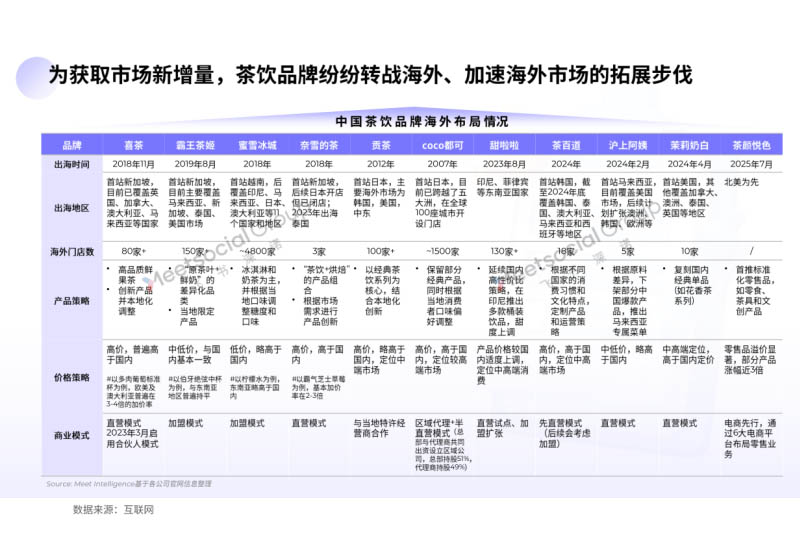

As the domestic tea beverage market enters the stage of stock competition, going global has become a new growth curve for tea beverage brands.

The "Panoramic Report on Chinese Tea Beverages Going Global" released by Feishu Shennuo (MeetIntelligence) focuses on the market opportunities and paths for Chinese tea beverages to "go global." The report clearly outlines the trends and breakthrough logic of the global tea beverage market through regional data, consumer behavior insights, and typical brand cases, providing important reference value for tea beverage companies, cross-border service providers, and investors.

Market Landscape

From an overall perspective, Chinese tea beverages are transitioning from "testing the waters" to "scaling up expansion." Among them, Southeast Asia has become the core market with the fastest growth, while markets in Europe, America, Japan, and South Korea are gradually opening up.

The ready-to-drink tea market in Southeast Asia is highly fragmented, dominated by mid-to-low-end brands. Local brands generally have low chainization levels, and no dominant leading brand has emerged. The Chinese brand Mixue Bingcheng performs well overall but faces competition from lower-priced local brands such as Haus and Esteh Indonesia.

The high-end market lacks dominant brands, and competition is relatively low. High-end Chinese ready-to-drink tea brands like HEYTEA and Nayuki Tea dominate this segment, leaving room for incremental development.

The price distribution is also clear: the budget market (<$2) is dominated by Mixue, the mainstream market ($2-$5) is occupied by CoCo and Gongcha, and the high-end market (>$5) is the domain of HEYTEA and Nayuki Tea.

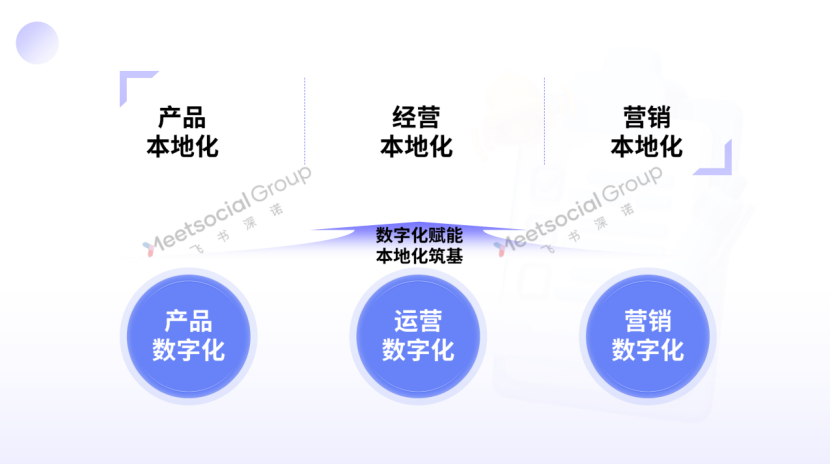

Localization Strategy

Whether tea beverage brands can establish a foothold overseas does not solely depend on location selection; the key lies in whether they can truly integrate into the local market in terms of products, marketing, and operations.

Product Localization: From flavors and ingredients to compliance requirements, brands need to adapt to local conditions. For example, introducing new flavors based on local dietary habits, using local ingredients to enhance familiarity, and even respecting religious and cultural customs in formulations and processes.

Operational Localization: Not only should brands open stores in core urban areas, but they should also leverage online platforms to integrate delivery, e-commerce, and social channels, achieving omnichannel coverage to improve reach and conversion.

Content Localization: Leveraging the influence of celebrities and local influencers can quickly build awareness and trust. Breaking through barriers by localizing IP or collaborating across industries. Combining local and international festivals for marketing to strengthen emotional connections and brand identity, and telling compelling "brand stories" in line with trending events to continuously enhance influence.

Brand Strategies

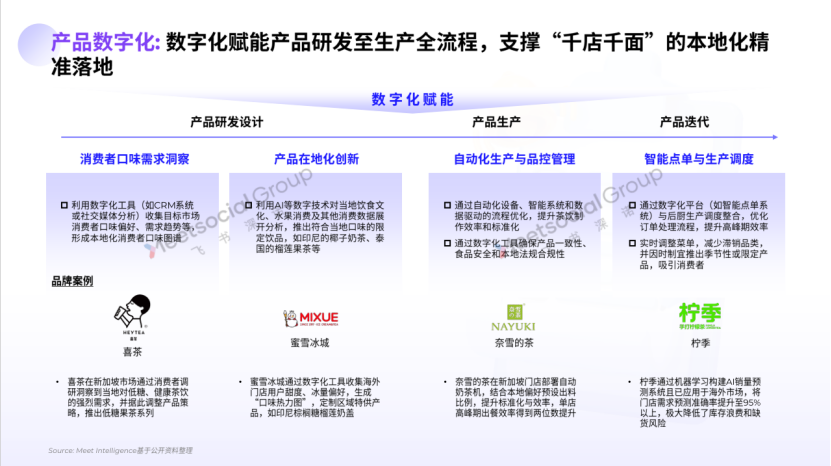

Based on the practices of leading brands, product digitization, operational digitization, and marketing digitization have become common paths to success in going global.

Mixue Bingcheng: IP Penetration + Supply Chain Cost Reduction

Centered around the "Snow King" IP, high-frequency interactions on platforms like Instagram (e.g., an average of 600+ interactions per post in the Indonesian market, totaling 14,000+) strengthen user recall. In terms of supply chain, Mixue has established 27 overseas warehouses covering 7 core regions, combined with MES production management systems and WMS warehouse systems, enabling low-cost and efficient operations for 45,000 stores globally.

HEYTEA: Premium Positioning + Social Marketing

Targeting the mid-to-high-end markets in Europe and America, store pricing ranges from $4 to $8. Leveraging topics like "CHAGEECNY" (with 20,000+ interactions on Instagram) and combining them with holiday marketing to precisely reach young consumers. In terms of channels, HEYTEA has partnered with delivery platforms like deliveroo and launched an English website (heytea.com), achieving a "offline experience + online ordering" closed loop.

Nayuki Tea: Cross-Border Collaborations + Category Innovation

Through cross-border collaborations with brands like VERSCTA, limited-edition products such as "TricksOrGrapes" have been launched, covering 50+ overseas markets. At the same time, combining "hand-brewed lemon tea" with local flavors to strengthen differentiated competitiveness.

Overall, the global expansion of Chinese tea beverages has shifted from "land grabbing" to "refined cultivation." In the future, as Chinese tea beverage brands continue to deepen their efforts in supply chains, products, and marketing, the "Chinese flavor" will create a larger wave globally.