Farewell to "Pure Chinese Style", Intensely Competing in Localization.

In the autumn season, when Heytea launched a mysterious blue beverage at its U.S. stores, the long queues instantly exploded on social media—this was not a sci-fi drink, but "Matcha Cloud Coconut Blue," which combines blue spirulina, coconut water, and matcha. The combination of health attributes and visual appeal made this product sell out immediately upon its launch in the UK, U.S., and Canada.

Heytea "Matcha Cloud Coconut Blue"

Image Source: Xiaohongshu @pipapo

A relevant person in charge at Heytea told Xiaguang Society that, as of now, Matcha Cloud Coconut Blue has sold over 700,000 cups cumulatively in overseas markets.

Behind this blue beverage reflects the collective shift in thinking among new tea beverage brands going global. In August, Heytea's overseas store count exceeded 100, Tianlala opened three stores simultaneously in Bali, and Chabaidao announced its landing in New York—while new overseas stores are opening, new tea beverages are no longer simply replicating domestic menus. Instead, they are turning stores into "regional blind box machines," grabbing the most popular and unique local ingredients to put on the menu wherever they go. Consumers, in the act of "opening blind boxes," simultaneously taste local flavors and Eastern tea flavors.

Image Source: Xiaohongshu @Tianlala

On the other hand, in the 3.0 era of new tea beverages going global, whoever "ignites" social topics first masters the opportunity for "explosive orders." Whether this "ignition" comes from taste, appearance, collaborations, or long queues outside the stores...

"Explosive Orders" Are the Instant Realization of "Social Currency"

In July this year, a casual photo of BLACKPINK member Lisa in a sports car unexpectedly sparked a global "matcha" consumption storm—the emerald green in the cup holder was precisely Heytea's "Triple Supreme Matcha."

Within 48 hours of the photo's release, from New York to Sydney, long queues formed at Heytea's overseas stores, with many stores in the U.S. and Australia quickly selling out. It is reported that "Triple Supreme Matcha Latte" is a product already validated domestically by Heytea and recently launched in multiple overseas countries.

Heytea Triple Supreme Matcha

Image Source: Xiaohongshu @芣深

This wave of green trend originating from celebrity influence is not simply about replicating "mature products" overseas but is a landing decision made after in-depth research on the local market.

In fact, in the domestic market, there are periodic appearances of popular tea beverage bases, from coconut, oil orange, yellow skin, mulberry, and pineapple bases in previous years to this year's bayberry and lychee bases. The integration of these seasonal limited-edition flavors seems to provide new tea beverage companies with endless inspiration.

The same applies overseas. Many tea beverage companies, while expanding globally, have also amplified the "limited edition" play.

In Malaysia, Mixue Bingcheng launched ice cream and tea beverages inspired by the local specialty spice, bak kut teh; in Vietnam, Mixue Bingcheng increased the overall sweetness and launched fruit teas with heavier flavors favored by locals, such as lemongrass and pineapple. BANDLUCK has also deeply penetrated Southeast Asia, incorporating Philippine purple sweet potato and Indonesian pandan leaves into the tea base. The "Durian Coconut Tieguanyin" launched in Indonesia once became a local hit. Nayuki's Tea, aligning with Thai consumers' preference for rich and strong flavors, launched limited series tea beverages like "Da Hong Pao Milk Tea" and "Lychee Rose Milk Tea" locally.

Recently, Tianlala launched "peach oolong milk tea" in Indonesia. Regarding the reason for launching this product, Tianlala told Xiaguang Society, "We observed that momoyo and Mixue Bingcheng, which are similarly priced, have not yet introduced Chinese-style light milk tea, while BANDLUCK belongs to the high-end tea beverage category with higher prices. Locals want to drink it, but their purchase frequency is limited by economic levels. Tianlala captured the locals' liking for light milk tea (demand), considering it fashionable, trendy, and healthy. Therefore, based on the hot sales of Qingfeng Mobaixian Milk Tea, Tianlala launched peach oolong milk tea. This product uses Taoyin Oolong tea as the base, paired with a milk base, continuing the domestic concept of 'healthy light milk tea' and the brand philosophy of low price, high value, and high aesthetics, which is deeply liked by locals."

Image: Tianlala "peach oolong milk tea"

Image Source: Official Account @Xiaguang Society

The decision based on in-depth market research also earned Tianlala's new product positive reviews immediately upon launch. According to Tianlala Indonesia's sharing, peach oolong milk tea sold nearly 400 cups in a single store in one day at its peak, steadily ranking as the sales TOP 1.

The same applies outside Southeast Asia. The "Matcha Cloud Coconut Blue" mentioned at the beginning is a limited edition launched by Heytea for overseas markets—the unique visual effect of blue spirulina + green matcha became the first choice for many netizens to check in. As of August 2025, the related topic views of Heytea's Matcha Cloud Coconut Blue on TikTok exceeded 500 million, sparking global discussion and a buying frenzy.

Image Source: Xiaohongshu @阿yun超爱修狗!

A relevant person in charge at Heytea revealed that the success of this product stems from Heytea's focus on user needs and continuous commitment to innovative R&D with inspiration.

"Globally, blue beverages are highly favored for their dreamy visual effects and refreshing taste. Beyond the visual appearance of the product, Heytea, combining the preference for 'superfoods' in European and American markets, innovatively combined spirulina, matcha, and coconut water to successfully launch Matcha Cloud Coconut Blue. These ingredients are already widely used in the healthy eating culture of Europe and America. Heytea skillfully integrated these elements into tea beverages, giving Matcha Cloud Coconut Blue a unique flavor experience that not only meets the aesthetic needs of global consumers but also precisely aligns with their desire for healthy beverages." the person in charge emphasized.

"2024 Z Generation Ready-to-Drink Beverage Consumption Insight Report"

Image Source: Hongcan Industry Research Institute

The "2024 Z Generation Ready-to-Drink Beverage Consumption Insight Report" shows that additional non-taste aspects such as product appearance design, aesthetics, and creative peripherals can better stimulate Z-generation consumers' desire to take photos and share.

According to research by Hongcan Industry Research Institute, in two typical scenarios—recording or sharing special moments and store check-ins—the proportion of Z-generation consumers purchasing ready-to-drink beverages and taking photos to share reached 27.3% and 20.9%, respectively. The institution also pointed out that consumers' spontaneous sharing can, to some extent, help ready-to-drink beverage brands achieve efficient secondary communication.

The product is the medium, and the taste is the topic. When a beverage's ingredient combination and color scheme fit consumers' cognitive framework, it automatically carries social transmission genes—consumers are no longer mere purchasers but become content co-creators and transmission nodes.

II. Bringing Chinese Supply Chains Overseas

Creating a new product that suits local tastes in an unfamiliar market is a huge challenge to the tea beverage company's original supply chain.

Wang Jie, co-founder of Ningji, once admitted: "(Going global) the biggest challenge is supply chain construction and efficiency issues. Different raw material access standards, transportation difficulties, differences in consumer tastes, etc., all require adjustments."

At the same time, food safety laws and regulations vary across regions. For example, the EU has 480 indicators for pesticide residue testing in tea, far exceeding domestic standards; new regulations effective in March 2025 further raised pesticide residue standards. Plastic packaging bans in Southeast Asia indirectly increase operating costs; Singapore's sugar content grading forces formula optimization. These compliance requirements pose severe tests for brands.

Adapting to different regional cultures is also an invisible barrier. European and American markets focus on organic health, while Southeast Asian markets prefer rich and sweet tastes, with some countries requiring halal certification; when conducting marketing activities for different holidays and traditional events, caution is needed everywhere.

Guming disclosed its product development process in its 2024 financial report, including six steps: idea generation and screening, finding suitable suppliers and raw materials, formula development, internal and in-store testing, and post-launch feedback collection.

Image Source: Guming 2024 Financial Report

The product development process revealed by a R&D personnel of a certain new tea beverage brand is slightly different from Guming's but generally similar. He also stated, "The traditional R&D model is like a clumsy elephant, developing new flavors requires 1-6 months, at least 20 samples, and possibly a budget of tens of millions."

During this period, it is also necessary to complete formula debugging, raw material procurement, taste testing, and compliance testing, including hard processes like food safety certification and shelf-life testing; after the product model is completed, the second step is to enter the supply chain construction phase (3-6 months), determining where to procure, how much to procure, whether supply can be guaranteed, stability and reliability, whether cold chain logistics can match, including磨合 with factories, all need to be determined at this stage; the third step is the brand system phase (3-6 months), at which point visual identity/IP design, pricing strategy, channel negotiation, and compliance document (production license/trademark registration) approval need to be determined. Finally, enter the market validation period, with simultaneous online and offline launch and promotion. During the trial sales period, adjust the product line based on user feedback, determine whether to increase procurement and inventory later, or whether to turn limited editions into permanent items.

Now, with the increasingly mature supply chain construction of various brands, the same process has been shortened by about half; moreover, with the addition of more efficient digital tools (e.g., through order data, market research data, social media trend analysis, etc.), the hit rate of flavor improvement and new product R&D has also greatly increased.

Therefore, we can see from the financial reports of related companies that Mixue Group has developed over 40 new products in the past few years, while independently developing and producing high-end zero trans-fat milk base powder, fresh milk base, etc., meeting consumers' health pursuits while saving costs. In 2024, Chabaidao, Nayuki's Tea, and Guming launched 60, 70, and 100 new products respectively, basically achieving uninterrupted "weekly new launches" throughout the year, which also侧面印证了 the confidence that a mature supply chain brings to enterprise new product R&D.

When pushing products to overseas markets, this advantage of the Chinese supply chain also plays a huge role.

Heytea's Refreshing Guava Series quickly became popular after its domestic launch in February this year. In less than two months, the product simultaneously landed in the U.S., UK, Singapore, Australia, and other markets, also triggering a buying frenzy among local consumers.

Heytea Refreshing Guava Series

Image Source: Xiaohongshu @杭州富阳万达广场

A relevant person in charge at Heytea stated that to allow consumers in different regions to drink products with a unified taste, Heytea has established multiple storage centers on the east and west coasts of the U.S., the UK, Malaysia, Sydney, and Melbourne in Australia, providing efficient storage and logistics services for local stores. The core product raw materials required by overseas stores are uniformly supplied by Heytea to ensure the consistency of store product quality.

"In the future, the North American supply chain team will continue to promote the localization of key raw material production and supply, further enhancing supply chain stability and规模化扩张能力。" the person in charge revealed.

Wang Huan, CEO of Chabaidao Overseas, mentioned that every time Chabaidao enters a new country, the R&D and operations teams arrive at the local market one month in advance to develop several products favored by local consumers. In product R&D, over 70% of the raw material formulas are self-developed by Chabaidao.

Taking Chabaidao's first European store in Barcelona, Spain, opened after this year's Spring Festival as an example, besides domestic hit products, the store also made appropriate product adjustments and innovations based on the taste preferences and dietary habits of Spanish local consumers, launching a locally特色限定饮品—Matcha Brown Sugar Pearl Milk Tea, widely praised by local consumers.

Image Source: Xiaohongshu @一天睡25小时

The R&D of overseas products must ultimately be combined with local consumption levels and dietary culture. For example, targeting Southeast Asians' habit of drinking coffee, Tianlala specially developed a "coffee + fruit" series of beverages. "We conducted tests, and the sales of coffee new products in various stores soared from the initial top 20 to now the top 6." Tianlala stated.

Beyond attracting consumers with new products, how to ensure "thousands of stores, billions of cups, taste as one" is also a major challenge for new tea beverage brands.

Tang Haitao, CTO of BANDLUCK, revealed that BANDLUCK currently has over 6,000 stores globally, and the signature item "Boya Juexian" sells approximately 100 million cups annually. For this product, the difficulty is no longer how to create a hit product but how to ensure that all stores can produce this cup of tea with identical quality.

"How do we achieve this thousand stores like one quality? On one hand, we standardized the equipment. In BANDLUCK's latest 3.0 stores, you can see an automated tea-making machine. After consumers place orders via mini-program, the tea-making machine scans the QR code on the cup to identify the corresponding flavor, then the machine starts making the tea according to the consumer's taste and the standard formula. It can now produce a cup of tea in 8 seconds, and no matter which store you are in, the taste of this cup of tea is the same. On the other hand, we standardized operations, making much frontline management rule-based through Feishu and AI. This step is meaningful for our frontline partners because standards and answers are no longer out of reach but are随时随地在他们的身边。So we often say that hit product quality uniformity does not rely on skill but on standards." Tang Haitao said.

III. "Cultural Reverse Export" Brings Hidden Dividends

Tea is not only China's "national drink" but also a beverage loved by over half of the world's population. Among the world's three major non-alcoholic beverages, tea ranks first.

A research report released by Shenwan Hongyuan shows that, calculated by terminal retail sales, the global ready-to-drink beverage industry's market size grew from $598.9 billion in 2018 to $779.1 billion in 2023, with a compound annual growth rate (CAGR) of 5.4%. It is expected that the CAGR from 2023 to 2028 will reach 7.2%, and the market size in 2028 will be $1,103.9 billion.

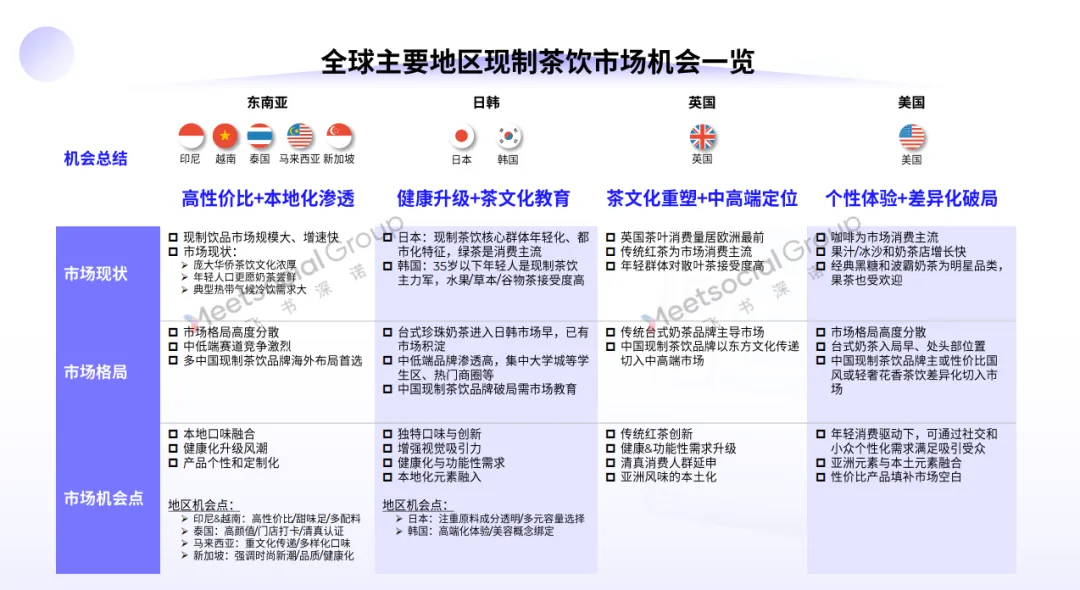

Under high growth rates, the global ready-to-drink beverage market shows clear regional differentiation. The Southeast Asian market, leveraging its large overseas Chinese population,young demographic characteristics, and typical tropical climate, has created business opportunities for the ready-made tea beverage category, but has already entered the red ocean of "competing on price"; the Japanese and Korean regions face new demands for health upgrades, with Japanese green tea dominating consumption, and Korean fruit tea/grain tea gradually becoming a trend; European countries have diverse tea drinking methods, with the UK being the largest tea consumer and having high per capita tea consumption, presenting a blue ocean in the mid-to-high-end market; the US region has consistently high popularity for milk tea, with a fragmented market structure and lack of leading players, and consumers prefer differentiated products...

"2025 China Tea Beverage Going Global Panoramic Report: Chinese Taste, World Trend"

Image Source: Feishu Shennuo

Formulating targeted strategies based on the differences in various markets and integrating Chinese tea culture with local cultures enable Chinese new tea beverage brands to quickly stand out in competition with local giants.

Heytea once launched the "California Sunset" limited edition at its Beverly Hills store. This tea beverage was inspired by California's world-renowned sunset scenery, cleverly incorporating the cultural characteristics and natural landscape elements of California. On the store's opening day, this product sold approximately 2,000 cups.

To successfully achieve localization in the South Korean market, Chabaidao also made many localized efforts. Wang Huan still remembers that when naming, the team specifically named "Jasmine Fresh Milk Tea" as "Mori Latte," which is closer in pronunciation to Chinese, rather than using the Korean pronunciation similar to the English "Jasmine." Now "Mori Latte" has become a category representative in South Korea.

Beyond products, store decoration and design have also become an important part of promoting Chinese culture. Taking Heytea as an example, its stores in many locations around the world are highly design-oriented: the London New Oxford Street store, near the British Museum, integrates the imagery of "ink and tea," constructing an ink wash space of "strolling in the garden, tasting tea, appreciating objects"; the Seoul Myeongdong store creates a Zen-like space of "high mountains and flowing water" through the three dimensions of "the form, color, and sound of water"; and the design inspiration for the New York Times Square TEA LAB store comes from Tang Dynasty poet Wei Yingwu's "Joy in the Garden with Raw Tea," creating a "city oasis" themed space.

Image Source: Xiaohongshu @椰丝Miranda, @圈圈元元圈圈, @Heytea

Centered around this design philosophy, Heytea creates deep experiences of "Chinese tea culture" within traditional European and American-style shopping malls and pedestrian streets.

At the marketing level, various brands have unanimously chosen representative spokespersons or partners to build cross-cultural dialogue capabilities with overseas consumers.

For example, when BANDLUCK entered Malaysia, it chose famous athlete Lee Chong Wei as its spokesperson; in 2025, after Stefanie Sun held the "Just After Sunset" concert, BANDLUCK officially announced her as its Asia-Pacific spokesperson. Over the past year, Heytea has successively conducted cross-border collaborations with globally renowned artists and trendy brands such as alexanderwang, Sandy Liang, "Tears of Themis," and Yayoi Kusama, with topics covering platforms like TikTok, Instagram, and Xiaohongshu.

Mixue Bingcheng, on the other hand, follows the approach of "IP first, stores later," with its Snow King animation currently being hotly broadcast overseas. Financial reports show that Snow King animation has been simultaneously launched on four major overseas channels, covering over 30 African countries, with an average first-round broadcast rating of 1.14% and a peak rating of 3.08%. At the same time, Snow King animation was also broadcast at the Cannes International Film Festival in France, showcasing Chinese brand power at the world's top film festival.

Will, a senior tea beverage professional in China, introduced to Xiaguang Society that Southeast Asian consumers never see snow, so they are very fond of "Snow King." "In China, few people buy Mixue Bingcheng's peripherals, but Thais really like Snow King IP-derived dolls, pendants, stationery, etc." During this year's Thai Songkran festival, Snow King, wearing a red cloak, sat on a water truck to start the Bangkok street parade. "Southeast Asians' recognition of Mixue Bingcheng is too high; even Cambodians, Laotians, and Burmese can accurately pronounce the two Chinese characters 'Mixue.'"

Image Source: Xiaohongshu @MixueBingchengThailand

These cases vividly demonstrate the possibilities of cultural integration. New Chinese-style tea beverage brands do not simply copy Chinese original flavors but combine the concepts of Chinese tea beverages with local ingredients, tastes, and dietary habits, thereby establishing a "resonant" cultural connection. This method of cultural export does not output a closed tradition but promotes an open, shareable cultural experience through subtle adjustments in taste.

All of this indicates that milk tea going global is no longer as simple as "selling products abroad."

In the past, cultural dissemination might have remained at the level of brand storytelling and product experience; today, truly profound cultural output emphasizes the "power of integration," subtle and imperceptible.

IV. Summary

Young scholar Zhang Xuan mentioned an observation in her new book "Milk Tea Going Global: The Global Expansion of New Chinese Tea Beverage Brands": on American streets, foreigners wearing T-shirts with brown sugar pearl culture are everywhere; during American companies' coffee time, office group chat emoji packs also began to include pearl tea fans. Milk tea, replacing coffee and alcohol, is chosen by many young people as their beverage for leisure.

The global expansion of new tea beverages is not about snatching a share of coffee from overseas consumers but fundamentally reshaping consumer habits.

This is not just a tea beverage battle but a cognitive revolution. It also预示了 the new stage of global competition for Chinese new tea beverage brands. Beyond traditional dimensions like efficiency and scale, cultural perception, aesthetic creativity, and emotional resonance are increasingly becoming the core competitive advantages for multinational brands to win hearts.

This expedition that began with commerce is evolving into a deep dialogue between different civilizations.

Reference Sources:

[1] "Domestic Competition Intensifies, Overseas Markets Become the 'Second Growth Curve'—Catering Industry Research Series Report II: Tea Beverage Going Global Chapter," Ping An Securities

[2] "Tea Beverage 'Going Global': Brand, Product, Supply Chain Are the Cornerstones—Interview with Chabaidao Overseas CEO Wang Huan," Xinhua Finance

[3] "2024 Z Generation Ready-to-Drink Beverage Consumption Insight Report," Hongcan Industry Research Institute

[4] "2025 China Tea Beverage Going Global Panoramic Report: Chinese Taste, World Trend," Feishu Shennuo