In the past two years, a significant trend has emerged in the tea beverage industry - going global.

As a result, we can now see the presence of Chinese brands on streets worldwide. In central business districts of Malaysia, young people take selfies holding milk tea cups with Chinese logos—the Chinese characters for "Mixue Bingcheng" on the cups create a fascinating contrast with the skyscrapers in the background. Outside Cha Bai Dao's new store near Konkuk University Station in Seoul, South Korea, queues often exceed 50 people, and even at 10 PM, the store entrance remains crowded. In London's Covent Garden, Nayuki's Tea introduced English scones paired with oriental tea, a "localized adaptation" strategy that has achieved a remarkable 45% repurchase rate in its overseas stores.

Data shows that the global freshly-made beverage market will exceed $1.1 trillion by 2028, with the compound annual growth rate (CAGR) for 2023-2028 rising to 7.2%. In tea-prevalent Southeast Asia, the market size will grow from $20.1 billion in 2023 to $49.5 billion in 2028, with a CAGR of 19.8%, making it one of the fastest-growing regions among major global markets.

However, it's undeniable that by 2024, the overseas expansion of China's new tea beverage brands has entered deep waters.

Behind the spectacular scene of "countless ships setting sail simultaneously" lies the ultimate test of supply chains, cultural adaptation, and business models. This article decodes the survival strategies of four major Hong Kong-listed tea beverage brands (Mixue Bingcheng, Nayuki's Tea, Cha Bai Dao, and Guming) to reveal the truths not fully articulated in their annual reports.

Key conclusions first:

1. Several listed new tea beverage companies are at different stages of overseas expansion: Mixue Bingcheng (scaling), Nayuki's Tea (premiumization), Cha Bai Dao (differentiation), Guming (regional focus).

2. Mixue Bingcheng leverages its supply chain advantages to build a tea beverage empire; Nayuki's Tea targets key districts in developed cities; Cha Bai Dao uses "fruit tea" to attract Korean coffee consumers; Guming relies on differentiated branding and positioning.

3. Tea beverage brands are rushing to list, but capital market attitudes are polarized. Based on current performance, brands using globalization narratives and those deeply cultivating regional cultural markets have both received high attention.

4. Deeply understanding local culture and precise positioning in segmented markets remain key for brands to break through.

Renting out an entire store on their birthday, inviting friends for ice cream and milk tea... This has become a new form of "social currency" among young people in Southeast Asia, and such scenes almost always occur in Mixue Bingcheng stores.

This intense "popular enthusiasm" continues to rise with Mixue Bingcheng's expansion in Southeast Asia. Recently, Indonesia's largest English-language daily, The Jakarta Post, reported a popular joke in Southeast Asia, essentially saying, "You must pay attention to any vacant space near your home, because it will soon become a new Mixue Bingcheng store."

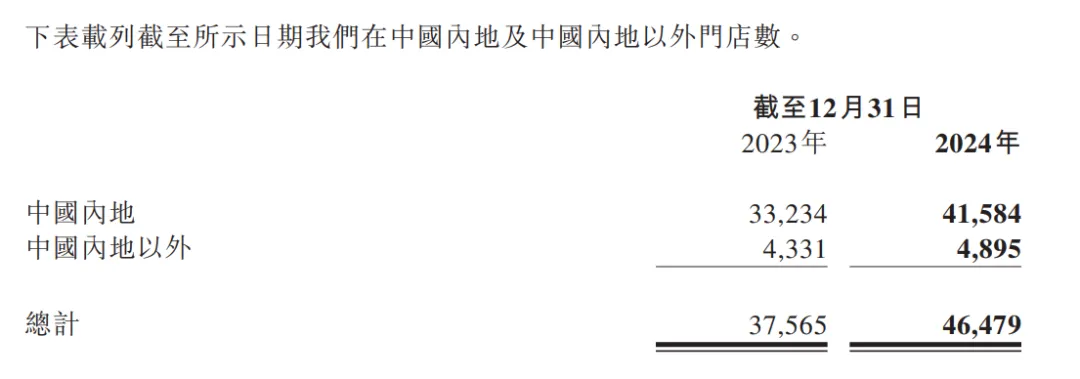

The latest financial report shows that as of December 31, 2024, the Mixue Group had 4,895 stores located outside Mainland China, an increase of 564 stores compared to the same period in 2023. In other words, over the past year, they opened an average of 10 new stores overseas per week.

Source: Mixue Bingcheng Financial Report

Behind the rapid expansion is Mixue Bingcheng's perfect replication of its domestic "extreme cost-effectiveness" strategy. Taking standard cups of ice cream and lemon water as examples, Mixue Bingcheng's pricing in Vietnam is 3-6 RMB, and in Indonesia, it's 3.7-4.6 RMB, creating a clear price gap with mid-to-high-end brands like Nayuki's Tea and Heytea.

Beyond pricing, a robust supply chain is another defensive moat for Mixue Bingcheng to prevent other tea beverage brands from entering its core territory.

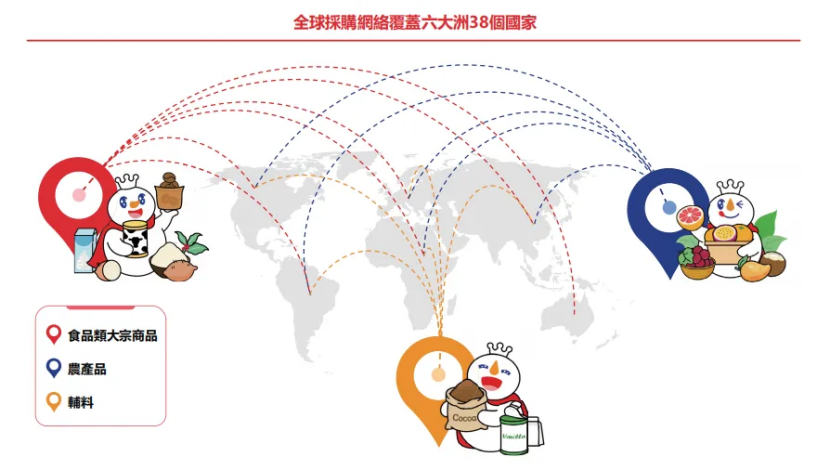

Source: Mixue Bingcheng IPO Prospectus

The prospectus indicates that Mixue Bingcheng was one of the earliest companies in China's freshly-made beverage industry to establish central factories. It possesses a comprehensive end-to-end supply chain system covering key links including procurement, production, logistics, R&D, and quality control, providing franchisees with competitive one-stop solutions. 100% of the core beverage ingredients supplied to franchisees are self-produced, which not only effectively controls production costs but also ensures product quality.

Specifically, Mixue Bingcheng's procurement list resembles a world map: milk powder from New Zealand, cocoa powder from Ghana, grapes from Spain, passion fruit from Vietnam, lemons from Chongqing... The massive procurement scale enables Mixue Bingcheng to purchase many core raw materials at prices below the industry average. Using lemons as an example, its procurement volume reached 115,000 tons in 2023. Through centralized procurement and direct sourcing from production areas, Mixue Bingcheng reduced lemon procurement costs by 25%. Even during the domestic lemon price surge in 2022, its end products did not increase in price.

Improved supply chain efficiency and lower raw material procurement costs have also brought higher profits to Mixue Bingcheng. The financial report shows that the gross profit margin for the company's merchandise sales increased from 28.8% in 2023 to 31.6% in 2024, far exceeding the industry average (25%).

Regarding logistics, as of December 31, 2024, the Mixue Group had established 27 warehouses in Mainland China and localized warehousing systems in 4 overseas countries; its distribution network covers 31 provinces in Mainland China and over 560 cities in 4 overseas countries.

Mixue Bingcheng South Korea Store Image

On the marketing front, Mixue Bingcheng employs different strategies based on regional characteristics. For example, in the Vietnamese market, franchisees skillfully use social media like Facebook and Zalo for localized marketing, rapidly integrating the brand into youth circles. In Indonesia, they leverage the cute and silly cartoon image of Snow King and his catchy dance moves performed outside stores to attract customers. Additionally, before entering different countries, Snow King undergoes "costume changes": in Japan, Snow King is portrayed as a passionate manga youth wearing traditional Japanese headgear; in South Korea, Snow King wears sunglasses and holds a microphone while rapping.

Yang Huaiyu, Senior Researcher at Xiazhe Liangshi Consulting Management Company and Consumer Goods Industry Analyst, stated: "While most tea beverage brands are still competing on co-branding creativity, the Mixue Group has already turned the Snow King IP into a super symbol through continuous content output. This accumulation of cultural assets provides an emotional bond for its global expansion."

Regarding future plans, Mixue Bingcheng stated in its financial report that it will continue to focus on developing the Southeast Asian market and expanding its local franchise store network there. It will also explore other markets as planned, considering factors such as population size, economic growth, income levels, local culture, and consumer preferences.

In March 2024, Nayuki's Tea founders Peng Xin and Zhao Lin toured Southeast Asia, visiting the store that opened in late 2023 in Bangkok's core area and investigating the Southeast Asian market.

This trip proved highly rewarding for both. The high average order values and encouraging sales figures significantly increased management's interest in further exploring overseas markets.

Peng Xin expressed that Nayuki intends to cultivate Southeast Asia like domestic cities: "After our tour, we found that across overseas markets and the entire tea beverage industry, prices are generally not lower than coffee; in many markets, the unit price of tea beverages is even much higher than coffee, including the US market and Southeast Asian markets."

Consequently, over the past year, Nayuki's Tea has successively entered Thailand, Singapore, and Malaysia. Including earlier stores, it currently has a total of 7 stores overseas.

Zhao Lin revealed at the earnings conference that they will quickly use healthier store models to expand in the already opened Southeast Asian markets, expecting to open about 20 stores in Thailand this year. Additionally, for markets not yet entered like the US, they will gradually cultivate consumer habits.

When expanding overseas, Nayuki's Tea's strategy is to use "cultural capital" to break through the price ceiling.

During the 2024 New Year period, Nayuki's first store in Thailand achieved a single-day turnover exceeding 300,000 Thai Baht, setting a new record. In August, Nayuki's Tea opened its first global flagship store in the world-class premium shopping district—Centralworld in Bangkok. This flagship store is located on the first-floor luxury zone of Centralworld, adjacent to numerous international luxury brands. Within three days of opening, the store's turnover approached 1 million Thai Baht, setting a new sales record for Nayuki's overseas stores. On October 25, Nayuki's Tea opened its third store in Thailand at One Bangkok, a new landmark in Bangkok. On opening day, the store was fully packed and very lively.

A representative from the Tourism Authority of Thailand stated at the opening ceremony that Nayuki's Tea has now become the most sought-after tea beverage brand in the Thai market. Beyond the fresh fruits and super high aesthetic appeal, Thai consumers regard Nayuki's Tea as a symbol of "fashion," "trend," and "quality."

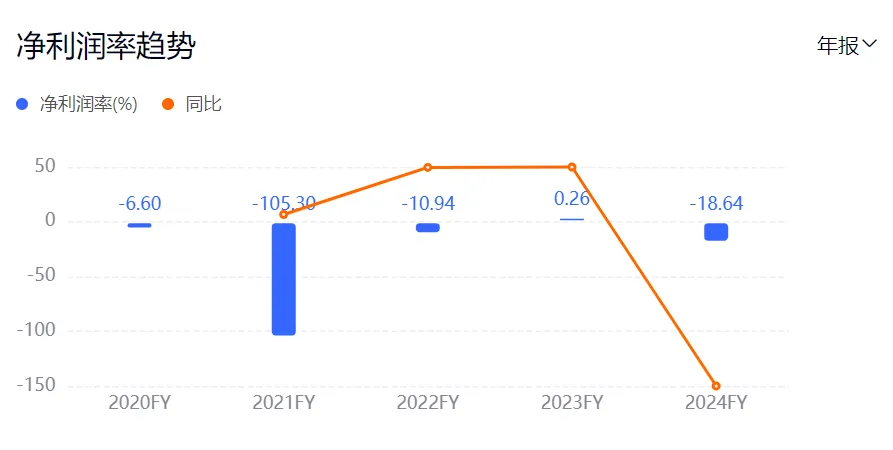

In contrast to its rising popularity overseas, the company's overall performance in 2024 shifted from profit to loss. The financial report shows that last year, the company's revenue was 4.921 billion RMB, a year-on-year decrease of 4.7%; adjusted net profit turned from a profit of 20.9 million RMB in 2023 to a loss of 919 million RMB in 2024, with the loss exceeding market expectations.

Nayuki's Tea Thailand Store Pricing

Despite the losses, Nayuki maintains its premium positioning. In 2024, the company's average customer spend per order from directly operated stores was 26.7 RMB, and the average daily order volume per tea store was 270.5 orders. Nayuki's Tea's prices are inherently high domestically, and they increased further after going overseas. In Thailand, Nayuki's Tea beverages are priced between 90-145 Thai Baht, slightly higher than domestic pricing; in Malaysia, prices range from 15.9-19.9 Malaysian Ringgit, averaging 25% higher than domestic prices; and in Singapore, prices are between 5-7.7 Singapore Dollars, approximately 30% higher than domestic prices.

Since Nayuki primarily uses a direct-operated model, the number of employees per store is 2-3 times that of franchise brands, making it more significantly affected by rising costs. Especially in foreign markets where rent and labor costs are higher, rising costs have a substantial impact on profitability. Looking at the financial report data, Nayuki's Tea's net profit margin in 2024 was -18.64%, a significant drop compared to the previous year.

Given the performance over the past year, Nayuki has adjusted its 2025 target to "return to profitability."

"In 2024, we had wishful thinking, hoping to win customers back through promotion and marketing, but I found that our entire model might need adjustment, including the product line," Nayuki's Tea Chairman Zhao Lin admitted at the earnings conference.

On November 29 last year, Cha Bai Dao's first store in Malaysia opened in Pavilion Bukit Jalil, the largest mall in southern Kuala Lumpur, significantly altering its previous domestic positioning of small, refined stores.

To succeed in the Malaysian market, Cha Bai Dao also established a substantial local operations team to support store operations. External rumors suggest they also hired two experienced PR managers from Feihe and poached a staff member from Luzhou Laojiao's PR agency.

To replicate the fruit tea model proven successful domestically in Malaysia, Cha Bai Dao put in considerable effort.

"The primary type of lemon cultivated in Malaysia is the yellow lemon, whose taste differs significantly from the Scented Lemons we use. To avoid compromising product quality, our team initially sought many suppliers in Malaysia and finally found Scented Lemons of the same quality as those used domestically to ensure product flavor," said a relevant responsible person from Cha Bai Dao.

Besides ensuring stable product flavor and quality, Cha Bai Dao actively integrates locally. For example, among local Malaysian consumers, ethnic Chinese prefer tea-based drinks, Cantonese-style sweet soups, etc., while Malays tend to prefer brown sugar milk tea with a strong milk flavor, cream-topped tea drinks, etc. Cha Bai Dao actively seeks the greatest common denominator aligning with local tastes, enriching its product matrix based on local consumption habits.

In South Korea, to successfully achieve localization, Cha Bai Dao made many localized efforts. Regarding products, Cha Bai Dao has 3-5 SKUs exclusively developed based on local preferences.

In naming, the team also brainstormed intensely. For example, Jasmine Fresh Milk Tea was named "Mori Latte," a pronunciation closer to Chinese rather than using the English reading of "Jasmine."

Cha Bai Dao even established its own tea beverage specialist training system in South Korea. Previously, there were no true tea beverage specialists locally. After entering South Korea, Cha Bai Dao began building a professional system for training, examining, and promoting tea beverage specialists, enhancing professional skills while advancing industry education and future standardization.

In the product supply chain, Cha Bai Dao also made localized adjustments. For instance, in the South Korean market, to address the supply issue of Tainong mangoes, the popular Yangzhi Ganlu drink switched to using South American Apple Mangoes. The amount of ice in cold drinks was adjusted according to South Korean consumer preferences. Additionally, Cha Bai Dao developed beverages using Hallabong, a unique Korean fruit, which became very popular among local youth.

The 2024 financial report shows that as of December 31, 2024, Cha Bai Dao had opened 7, 2, 2, 2, and 1 stores in South Korea, Malaysia, Thailand, Australia, and Hong Kong SAR China, respectively. This indicates that Cha Bai Dao's overseas expansion primarily focuses on China's neighboring countries and regions.

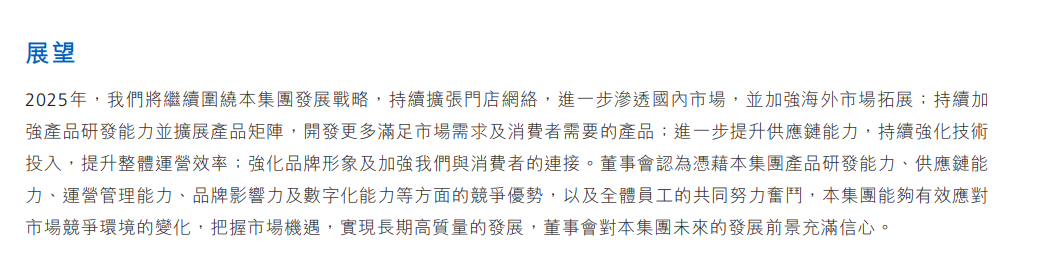

In the company's 2025 outlook, Cha Bai Dao explicitly listed "Overseas Expansion" in the first line: "In 2025, we will continue to focus on the Group's development strategy, persistently expand the store network, further penetrate the domestic market, and strengthen overseas market exploration."

Source: Cha Bai Dao Financial Report

"One strategy per location" in markets like Malaysia and South Korea became key to Cha Bai Dao's success, while another company, Guming, remains more focused domestically and maintains a cautious attitude towards overseas expansion.

Information from the IPO prospectus shows that Guming firmly targets lower-tier markets. The prospectus indicates that as of December 31, 2023, 79% of Guming's stores were located in Tier 2 and lower cities—the highest proportion among the top five mass-market freshly-made tea beverage brands—which increased to 80% by September 30, 2024.

Throughout the entire prospectus, Guming rarely mentions "overseas expansion" and doesn't even express intent to enter Tier 1 cities.

In the latest released 2024 annual report, Guming's outlook remains: "We will continue to increase store density within the 17 provinces where we have already established a presence." — "As of December 31, 2024, there are still 17 provinces across the country where we have not yet established a presence, leaving broad space for our development. We will strategically enter provinces adjacent to those where we have already established a presence."

Simultaneously, Guming's attitude towards overseas expansion remains relatively cautious, stated in the annual report as: "We will also continuously evaluate opportunities to enter overseas markets, prioritizing markets with huge growth potential in the freshly-made beverage sector, and will also consider building supply chain infrastructure and expanding our platform to support an overseas store network."

Compared to Mixue Bingcheng's aggressive expansion and Nayuki's Tea's high-profile approach, brands like Cha Bai Dao and Guming tend to choose specific regions for deep cultivation, relying on "precision targeting" to stabilize their market position.

Due to some well-known reasons, the entire overseas expansion circle has faced significant challenges recently, and the tea beverage industry is no exception.

The first challenge is the implementation of new environmental regulations in various countries. Thailand has been progressively advancing the "Roadmap on Plastic Waste Management 2018-2030" in recent years. According to the roadmap, Thailand banned plastic microbeads, oxo-degradable plastics, etc., by the end of 2019; stopped using lightweight plastic bags thinner than 36 microns, plastic straws, foam plastic food containers, plastic cups, etc., by 2022; and aims to achieve 100% plastic waste recycling by 2027. The Malaysian government plans to completely ban merchants from using plastic bags by 2025 at the latest, a measure that also includes nationwide merchants and roadside stalls. Indonesia plans to comprehensively ban single-use plastic products by the end of 2029, including polystyrene for food packaging, plastic straws, plastic cutlery, and plastic shopping bags.

Companies' adoption of various eco-friendly materials will undoubtedly increase costs. Taking straws as an example, paper straws and biodegradable straws cost more than ordinary plastic straws. One plastic straw costs about 0.01 RMB, one paper straw costs about 0.03 RMB, and one biodegradable PLA straw costs about 0.05 RMB. Just this one item could increase costs by up to 5 times.

The second challenge is the counterattack from local brands. In Indonesia, the local brand Tehbotol acquired the regional distribution rights of a certain Chinese brand, gaining supply chain technology and store management systems, and subsequently launched similar products at 20% lower prices. The Vietnamese tea drink brand Phuc Long also attempted to use "Vietnamese-style coffee milk tea" to compete against Chinese brands.

According to a Vietnamese businessman, the smartest Vietnamese entrepreneurs are now doing two things: either acting as agents for Chinese brands or creating 1:1 imitations of Chinese models.

Finally, the perennial issue of the supply chain. "The endgame in overseas markets is dual control over the supply chain system and cultural discourse power," wrote a certain brand CEO in their annual report message.

Zhu Danpeng, a Chinese food industry analyst, also stated that the core of future enterprise competition lies in the completeness of the supply chain. To generate brand effect, scale effect, and fan effect overseas, especially regarding quality and food safety, the supply chain is indispensable. Therefore, we cannot engage in blind expansion without first establishing a robust supply chain, because expansion is a concrete manifestation of supply chain capability. Without supply chain support, Chinese tea beverage brands cannot rapidly scale up overseas, nor can they operate with precision and depth.

Wanlian Securities analyst Ye Boliang believes that new tea beverage companies face two major challenges when expanding overseas: First, raw material supply. Companies need to establish reliable supply chain systems under the constraints of seasonal variations and logistics limitations across different countries and regions, while balancing localized procurement for cost reduction with maintaining product consistency. Second, cultural background. Overseas consumers generally have lower awareness of tea culture. Companies still need to conduct effective market promotion and brand education, conveying the unique value and cultural connotations of new tea beverages to cultivate consumers' tea drinking habits.

On the other hand, although many tea beverage brands are actively embracing the capital market, its attitude has begun to polarize.

Nayuki's Tea stock price has fallen from its IPO price of HK$19.8 per share to the latest closing price of HK$1.12 per share, evaporating over 90%. Cha Bai Dao's IPO price was HK$17.5 per share, and a year later, it stands at only HK$9.48 per share.

Other brands have experienced significant gains. Mixue Group's stock price soared after listing, with its highest market capitalization reaching HK$190 billion. Guming's rise is even more pronounced; its market capitalization has doubled from the initial HK$30 billion at listing to HK$60 billion. Auntie Shanghai, which just listed yesterday, opened with a surge of 68% and maintained a gain of over 40% by the close. During the subscription period, Auntie Shanghai was oversubscribed over 3,400 times, with subscription amounts exceeding HK$94 billion, setting a record for Hong Kong stock IPO subscriptions this year.

A recently released report by Strategy&, "Chasing the Southeast Asian Dream – Research Report on the Overseas Expansion of Freshly-made Beverages," emphasizes that although domestic new tea beverage brands seem to have natural competitive advantages when entering Southeast Asia, capturing the Southeast Asian market is not easy. Besides the varying development paces of the freshly-made tea beverage markets in different Southeast Asian countries, against a backdrop of regional fragmentation and diverse religious cultures, "one strategy fits all" doesn't work across Southeast Asia.

Yang Qianqian, an analyst at Strategy&, believes that Southeast Asia's tea beverage market will enter a "survival showdown" within three years, where lacking sustained hit product R&D capability will lead to elimination. The intense competition seen in China's domestic tea beverage market will undoubtedly extend to Southeast Asia. The Southeast Asian freshly-made tea beverage industry will soon enter a stage where "innovation density determines survival probability."

When there's no room left to compete domestically, going overseas becomes a necessity. But soon, overseas markets will witness a new round of intense competition and rebirth.

For now, the true game-changers have yet to emerge. The next industry reshuffle might be hidden within the reports of the coming fiscal year.