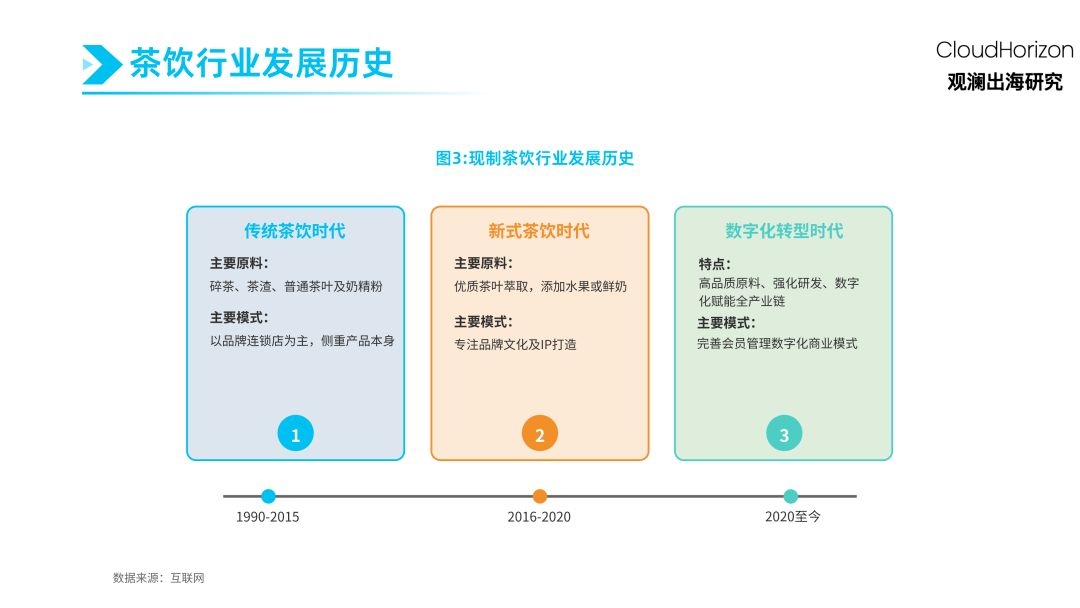

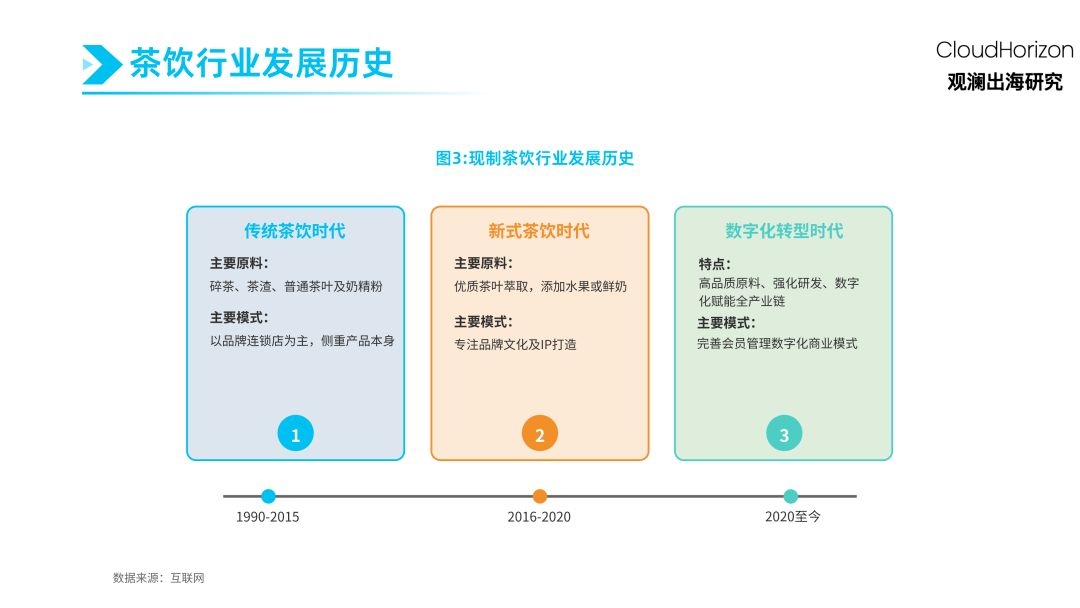

-

HOME > NEWS > Industry News

Venturing into Southeast Asia: A Market Study on the "Going Global" of Chinese Tea Beverage Brands

At its IPO, Chagee achieved a valuation of $2.1 billion, creating a new billionaire in its 30-year-old founder Zhang Junjie. Its exploration of Chinese tea beverage globalization also holds positive significance.

This IPO raised $411 million, with Chagee's American Depositary Shares (ADSs) surging 16% on their first trading day to close at $32.44. This performance sharply contrasts with the subdued atmosphere surrounding large-scale US IPOs of Chinese companies over the past two years. Previously, influenced by factors such as Sino-US tensions, Chinese firms' US listing activities had nearly frozen.

Chagee's IPO is more than a company milestone; it serves as a potential bellwether, indicating the market's willingness to make selective bets on quality Chinese consumer brands. The prerequisite is that these brands possess a healthy unit economic model and a clear international growth story, even within the current complex and volatile geopolitical landscape.

Chagee's international journey stems from its rise within China's intensely competitive freshly-made beverage market. According to estimates by the China Chain Store and Franchise Association (CCFA), this market's annual sales have exceeded 550 billion yuan (approximately $800 billion). In this vast Chinese market, rapid product iteration, fierce price competition, and constantly shifting consumer habits have equipped Chinese tea beverage brands with formidable capabilities. The gradual saturation of the domestic market and the extremely high store density in first- and second-tier cities compel brands to penetrate lower-tier markets with relatively less consumption power and actively seek growth beyond China. These are key drivers accelerating Chinese tea beverage brands' global expansion. On the other hand, the rapid export of Chinese culture and the acceleration of overseas cultural exchange also facilitate this global push.

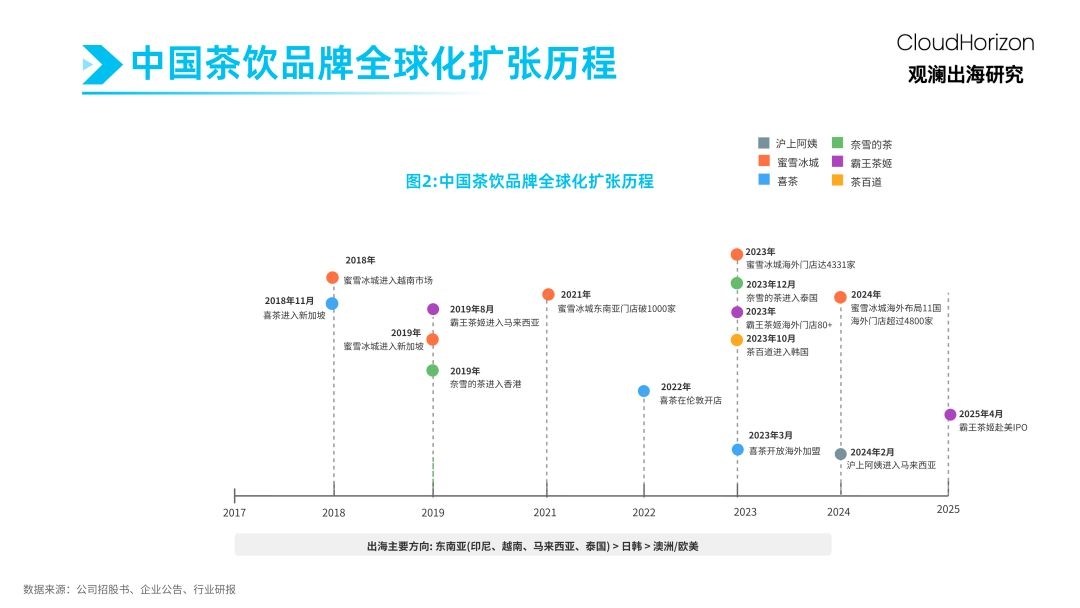

Tea Beverage "Great Voyage": A Surging Wave of Global Expansion

Chagee is just a prominent example within this wave of Chinese tea beverage brands going global. Driven by both domestic market pressures and the higher growth potential and profit margins overseas, these companies are accelerating their efforts to plant their flags globally, especially in Southeast Asia.

Leading by absolute scale is Mixue Bingcheng. Since opening its first overseas store in Hanoi, Vietnam in 2018, its international network has grown explosively. By the end of 2024, it had reached 11 countries with a total of over 4,800 overseas stores. Its strategy relies on aggressive franchising expansion and cleverly leverages existing local Chinese business networks (initially utilizing channels of smartphone brands like OPPO and VIVO). Its extremely low price point (typically $1-2 per cup), even when slightly higher overseas due to logistics and import costs (e.g., about 1.3-1.4 times the domestic price in China in Indonesia), still poses a significant price shock to established brands like Starbucks and local chains.

Following closely behind Mixue Bingcheng, mid-to-high-end brands are also actively deploying:

* Heytea: Has entered 7 countries including Singapore, the UK, Australia, Canada, and the US. Site selection emphasizes high-traffic urban core areas, targeting consumers familiar with global consumption trends and with higher quality demands.

* Nayuki: Has opened an overseas flagship store in Bangkok, Thailand, demonstrating its intent to compete in the premium market of major Southeast Asian capital cities.

* Chagee: In addition to its recent Nasdaq IPO providing funding for subsequent expansion, it already has over 150 international stores in Malaysia, Thailand, Singapore, and other locations, adhering to its core "fresh milk tea" positioning and unified brand image.

* Other Players: Relatively smaller but equally ambitious chains like CoCo, Gong Cha, and Guming are also actively expanding their international footprints.

The collective shift of Chinese tea beverage brands towards the Southeast Asian (SEA) market is not coincidental. The region converges multiple favorable factors, making it an almost perfect "second home market":

- Market Scale and Explosive Growth:

According to data (presumably from a market report), the Southeast Asian freshly-made beverage market reached $20.1 billion in 2023 and is projected to soar to $49.5 billion by 2028, with a Compound Annual Growth Rate (CAGR) as high as 19.8%. Within this, the freshly-made tea segment is growing even faster, expected to increase from $6.3 billion to $16.6 billion over the same period, with a CAGR of 21.3%. This growth rate far exceeds the global average (approximately 7.2%), contrasting sharply with more mature markets. - Demographic Dividend:

Southeast Asia boasts a notably young population structure. Countries like Laos (median age 23.5), Cambodia (24.8), the Philippines (25.7), and Indonesia (29.7) possess vast populations of Gen Z and Millennial consumers—the core audience for trendy, accessible luxury items like new-style tea beverages. This contrasts with the aging population challenges faced in East Asia and some Western countries. - Favorable Operating Environment:

- Climate:

Most of Southeast Asia has a tropical climate, meaning demand for cold drinks is strong year-round, significantly reducing the seasonal fluctuations common in northern regions of China. - Cost Structure:

Despite variations across countries, labor and rental costs in many Southeast Asian markets are still significantly lower than in China's first-tier cities. This creates the potential for improving unit economic models, especially for franchising models. - Cultural Affinity:

Shared cultural elements and historical preferences for tea beverages in many Southeast Asian countries may lower the barriers to market entry and consumer acceptance compared to Western markets. - Low Chainization Rate:

The market is currently highly fragmented. It is estimated that the chainization rate for freshly-made tea beverages in Southeast Asia is less than 10%, compared to approximately 40% in China. This leaves immense space for Chinese brands with mature chain operation experience and capital strength to leverage their advantages in standardization and scale to consolidate the market.

Overseas Expansion Strategies: Differentiated Path Choices

Freshly-made tea beverage brands exhibit diversified strategic paths for global expansion, mainly categorized into the following models:

(I) The Mixue Bingcheng Model: Scale is King, Price Leads

Mixue Bingcheng leads the overseas expansion trend with the model of "Extreme Value for Money + Franchise-Driven + Regional Dense Network":

- Expansion Speed and Scale:

Since opening its first overseas store in Vietnam in 2018, the number of overseas stores had exceeded 4,800 by the end of 2024, covering 11 countries and regions. This includes 2,667 stores in Indonesia and 1,304 in Vietnam, achieving economies of scale in regional markets. - Franchise-Driven Strategy:

Replicates its successful domestic franchising model in Southeast Asia, accelerating expansion through highly attractive terms (e.g., waiving two-year franchise and management fees in Vietnam). Initially leveraged the channel resources of Chinese brands like OPPO and VIVO in Southeast Asia to quickly build a franchisee network. - Pricing and Supply Chain Strategy:

Overseas product pricing, though higher than domestic (in Indonesia about 1.3-1.4 times the domestic price), still maintains a significant price advantage compared to local competitors. Material supply largely relies on domestic sources, with only perishables procured locally. Plans to build a multifunctional supply chain center in Southeast Asia by 2025 to increase the proportion of local procurement from the current ~30% to 50%.

(II) The Chagee Model: Differentiated Products, Capital-Driven

Chagee has charted an overseas path of "Focus on Fresh Milk Tea + Capital Markets + Differentiated Brand":

- Product Differentiation:

Adhering to the core positioning of "Fresh Milk Tea with Original Leaf," creating a unique selling point in a market with severe product homogeneity. From 2022 to 2024, approximately 79%/87%/91% of CHAGEE's GMV in China came from its signature fresh milk tea with original leaf, with about 44%/57%/61% contributed by the top three best-selling original leaf fresh milk tea products. - Efficient Operational Model:

Enhancing store efficiency through a big single-item strategy, utilizing automated equipment to enable staff to produce a standard beverage in 8 seconds. The top 30% of stores achieve daily sales exceeding 1,300 cups, laying the foundation for unified quality control in overseas stores. - Capital Market Empowerment:

Successfully listed on NASDAQ in April 2025, raising $411 million to provide ample funding for global expansion. The prospectus explicitly allocates part of the funds to accelerate international layout, particularly the supply chain construction in Asian markets.

(III) Premium Brand Model: Refined Strategy, Urban Core

Premium brands represented by Heytea and NAYUKI adopt the strategy of "Boutique Stores + Core Business Districts + Brand Upgrade":

- Selective Entry:

Heytea has entered 7 countries including Singapore, the UK, Australia, Canada, and the USA, but with a limited number of stores, adopting a boutique route. - Core Business District Strategy:

Store locations focus on core business districts and high-end shopping malls, prioritizing brand image building. For example, NAYUKI opened a flagship store in a well-known commercial complex in Bangkok, Thailand. Brand Upgrade and Localization:

By integrating local cultural elements and launching innovative products that suit local tastes, these brands emphasize their fashionable and premium positioning to attract quality-conscious consumers.

Figure 3: Global Expansion Status of Major Tea Beverage Brands

Future Outlook: Long-term Potential of Tea Beverage Globalization

(I) Market Expansion Space Forecast

- Deep Penetration in Southeast Asia:

Based on population density calculations, major Southeast Asian markets still have significant room for penetration. Taking Mixue Bingcheng as an example, even in its most densely deployed markets like Indonesia and Vietnam, the store density (0.96/1.30 stores per 100,000 people) is still lower than its lowest density province in China (1.68 stores per 100,000 people). Based on population figures, the eight Southeast Asian countries alone have a growth potential of over 15,000 stores. - Breakthrough in High-end European and American Markets:

As the influence of Chinese tea culture increases, acceptance of high-quality Chinese-style tea beverages is gradually rising in European and American markets, which are expected to become key expansion areas in the next stage. - Next-generation Product Innovation:

With the development of the "Tea-ification" trend, innovative beverages centered on tea will continue to emerge, potentially replicating the global success path of coffee.

(II) Global Industry Chain Integration and Cultural Export

- Global Tea Industry Chain Integration:

The global expansion of Chinese tea beverage brands will drive the upgrade of the entire industry chain, including tea cultivation, processing, and equipment manufacturing, enhancing China's voice in the global tea industry. - Expanded Cultural Influence:

Through the modern medium of freshly made tea beverages, traditional Chinese tea culture is expected to reach the world in a more accessible way, strengthening China's cultural soft power. - Innovative Model Export:

The innovative digital operation models, membership systems, and supply chain management experience of Chinese tea beverage brands will have a profound impact on the global food and beverage retail industry.

Conclusion: Chinese Tea Beverages Moving Towards Globalization

The global expansion of Chinese-style tea beverages is in an accelerating phase. This process is not only an expansion of corporate business territories but also an export of Chinese culture and business models. Unlike the globalization of Coca-Cola and Starbucks, which represents the export of American culture and business models, the globalization of Chinese tea beverages carries the modern interpretation and innovative diffusion of Chinese tea culture.

As brands such as Mixue Bingcheng, CHAGEE, and Heytea continue to deepen their presence in international markets, Chinese-style tea beverages are poised to become the next truly globally influential beverage category after American-style coffee. During this process, how to balance standardization with localization, and how to address challenges such as supply chain, talent, and cultural adaptation will determine the speed and depth of the globalization of Chinese tea beverages.