-

HOME > NEWS > Industry News

Financial reports tell the truth: The real situation of Chinese tea drinks expanding overseas

In recent years, a significant trend has emerged in the tea beverage industry — expansion overseas.

Consequently, we can now see the presence of Chinese brands on streets around the world. In the central business district of Malaysia, young people take selfies holding milk tea cups with Chinese logos — the Chinese characters for "Mixue Bingcheng" on the cup form a fascinating contrast with the skyscrapers in the background. Outside the new store of CHABAIDAO near Konkuk University Station in Seoul, South Korea, the queue of customers often exceeds 50 people; even at 10 p.m., the entrance remains crowded. In London's Covent Garden, Nayuki's Tea offers British scones paired with Oriental tea, a "localization adaptation" strategy that has resulted in a customer repurchase rate as high as 45% in its overseas stores.

Data indicates that the global made-to-order beverage market will exceed $1.1 trillion by 2028, with the compound annual growth rate (CAGR) from 2023 to 2028 rising to 7.2%. In Southeast Asia, where tea beverages are highly popular, the market size is projected to grow from $20.1 billion in 2023 to $49.5 billion in 2028, achieving a CAGR of 19.8%, making it one of the fastest-growing regions among major global markets.

However, it is undeniable that the overseas journey of China's new tea beverage brands has entered deep waters in 2024.

Behind the flourishing scene of "thousands of ships setting sail," lies the ultimate contest of supply chains, cultural adaptation, and business models. This article decodes the overseas survival strategies of four major tea beverage brands listed on the Hong Kong stock market (Mixue Bingcheng, Nayuki's Tea, CHABAIDAO, and Guming), revealing the truths not fully articulated in those annual reports.

First, the conclusions:

1. Several listed new tea beverage companies are at different stages of overseas expansion: Mixue Bingcheng (Scaling), Nayuki's Tea (Premiumization), CHABAIDAO (Differentiation), Guming (Regional Deep Cultivation).

2. Mixue Bingcheng leverages its supply chain advantage to build a tea beverage empire; Nayuki's Tea targets key districts in developed cities; CHABAIDAO uses "fruit tea" to attract South Korea's coffee consumers; Guming relies on differentiated branding and positioning.

3. Tea beverage brands are rushing to go public, but capital market attitudes are polarized. Based on current performance, brands leveraging a globalization narrative to attract capital and those deeply cultivating regional markets have both gained significant attention.

4. Deeply understanding local culture and precisely targeting niche markets remain the key to brand breakthrough.

Renting out an entire store on one's birthday, inviting friends for ice cream and bubble tea... This is the new "social currency" among young people in Southeast Asia, and such scenes almost exclusively take place inside Mixue Bingcheng stores.

This explosive "popular acclaim" continues to rise as Mixue Bingcheng expands in Southeast Asia. Recently, *The Jakarta Post*, Indonesia's largest English-language daily, reported a popular joke circulating in Southeast Asia. The gist of it is, "You must pay attention to any vacant space near your home, because it will soon turn into a new Mixue Bingcheng store."

In March 2024, Nayuki's Tea founders Peng Xin and Zhao Lin visited Southeast Asia. They toured stores that opened in late 2023 in Bangkok's core areas and conducted market research.

The trip proved highly fruitful. High average order values and encouraging sales figures were positive signals that significantly boosted management's interest in further expanding overseas markets.

Peng Xin stated that Nayuki intends to cultivate Southeast Asian markets as deeply as domestic cities. "After our tour, we found that across overseas markets and the tea beverage industry, prices are generally not lower than coffee; in many markets, including the U.S. and Southeast Asia, the unit price of tea beverages is even significantly higher than that of coffee."

Therefore, over the past year, Nayuki Tea has successively expanded into Thailand, Singapore, and Malaysia. Including previous stores, it currently has a total of 7 stores overseas.

Zhao Lin revealed at the earnings conference that the company will next rapidly deploy healthier store formats in the already established Southeast Asian market, with plans to open about 20 stores in Thailand this year. Additionally, for markets not yet entered, such as the United States, the company will gradually cultivate consumer habits.

When expanding into overseas markets, Nayuki Tea's strategy is to use "cultural capital" to break through the price ceiling.

During the 2024 New Year period, the daily revenue of Nayuki's first store in Thailand exceeded 300,000 Thai Baht, setting a historical record. In August, Nayuki Tea opened its first global flagship store in the world-class high-end shopping district—Centralworld in Bangkok. This flagship store is located on the first floor of Centralworld's luxury section, adjacent to several international luxury brands. In its first three days of operation, the store's revenue approached 1 million Thai Baht, setting a new sales record for Nayuki's overseas stores. On October 25, Nayuki Tea opened its third store in Thailand at One Bangkok, a new landmark in Bangkok. On the opening day, the store was fully occupied and very lively.

A representative from the Tourism Authority of Thailand stated at the opening ceremony that Nayuki Tea has now become the most sought-after tea beverage brand in the Thai market. Beyond fresh fruits and high aesthetic appeal, Thai consumers regard Nayuki Tea as a symbol of "fashion," "trend," and "quality."

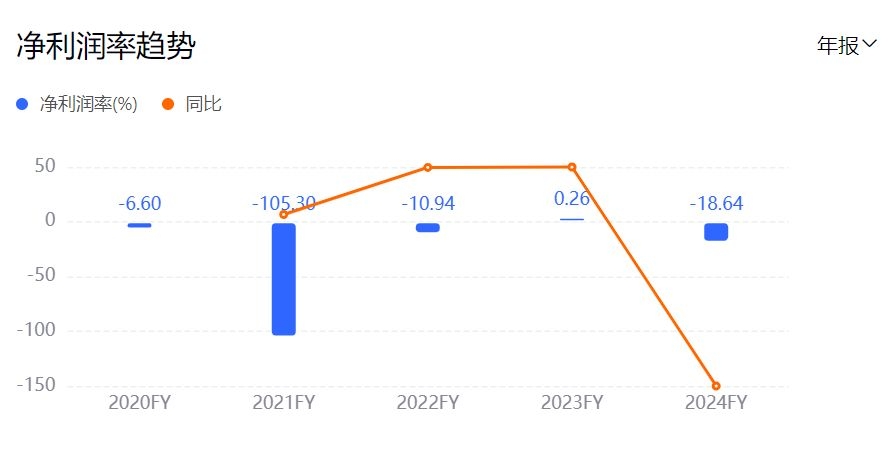

In contrast to its rising popularity overseas, the company's overall performance in 2024 shifted from profit to loss. Financial reports show that over the past year, the company's revenue was 4.921 billion yuan, a year-on-year decrease of 4.7%. Adjusted net profit turned from a profit of 20.9 million yuan in 2023 to a loss of 919 million yuan, with the loss exceeding market expectations.

Pricing at Nayuki's Tea Stores in Thailand

Despite operating at a loss, Nayuki maintains its premium positioning. In 2024, the company's average spending per order from directly operated stores was 26.7 yuan, with an average daily order volume of 270.5 orders per tea shop. Nayuki's Tea already commands relatively high prices domestically, and its prices are even higher in overseas markets. In Thailand, Nayuki's Tea beverages are priced between 90-145 Thai Baht, slightly higher than domestic pricing. In Malaysia, the prices range from 15.9 to 19.9 Malaysian Ringgit, averaging about 25% higher than domestic prices. In Singapore, prices are between 5-7.7 Singapore Dollars, approximately 30% higher than domestic prices.

As Nayuki primarily operates under a direct ownership model, the number of employees per store is 2-3 times that of franchise brands, making it more significantly impacted by rising costs. Especially in foreign markets where rent and labor costs are higher, the increase in costs has a substantial impact on profitability. According to financial report data, Nayuki's Tea recorded a net profit margin of -18.64% in 2024, a significant decline compared to the same period last year.

Based on its performance over the past year, Nayuki has adjusted its 2025 target to "achieve profitability."

"In 2024, we harbored a sense of wishful thinking, hoping to bring customers back through promotion and marketing. However, I realized that our entire model might need adjustment, including the product line," admitted Zhao Lin, Chairman of Nayuki, during the earnings call.

On November 29 last year, Chabaidao's first store in Malaysia opened at Pavilion Bukit Jalil, the largest shopping mall in southern Kuala Lumpur, marking a departure from its previous small and refined store positioning in China.

To succeed in the Malaysian market, Chabaidao has also established a sizable local operations team to support store operations. Rumors suggest it hired two experienced public relations managers from Feihe and poached a staff member from the PR agency of Luzhou Laojiao.

To replicate the fruit tea recipes validated in the domestic market in Malaysia, Chabaidao has put in significant effort.

"The lemons grown in Malaysia are primarily yellow lemons, which taste significantly different from the fragrant lemons we use. To avoid compromising product quality, our team initially searched for many suppliers in Malaysia and finally found fragrant lemons of the same quality as those used domestically to ensure the product's flavor," said a relevant person in charge of Chabaidao.

In addition to ensuring stable product flavor and quality, Chabaidao actively integrates into local markets. For example, among local consumers in Malaysia, Chinese consumers tend to prefer tea-based drinks and Cantonese-style sweet soups, while Malays prefer brown sugar milk tea with a strong milk flavor and cream-topped tea drinks. Chabaidao actively seeks the greatest common denominator that aligns with local tastes and enriches its product matrix based on local consumption habits.

In South Korea, to successfully achieve localization, Chabaidao has made many efforts tailored to local conditions—in terms of products, Chabaidao has 3-5 SKUs exclusively developed based on local preferences.

In naming, the team also racked their brains. For example, the jasmine fresh milk tea was named "Mori Latte," which phonetically is closer to Chinese, rather than using the English pronunciation "Jasmine."

Chabaidao has even established its own tea drink specialist training system in South Korea. Previously, there were no true tea drink specialists in South Korea. After entering the South Korean market, Chabaidao began establishing a professional training, examination, and promotion system for tea drink specialists, enhancing professional skills while furthering industry education and future standardization.

In terms of product supply chain, Chabaidao has also made localization adjustments. For example, in the South Korean market, to address the supply issue of Taiwanese mangoes, the popular Yangzhi Ganlu (Mango Pomelo Sago) now uses South American apple mangoes. Additionally, the amount of ice in cold drinks has been adjusted according to South Korean consumer preferences. Furthermore, Chabaidao has developed beverages using Hallabong, a unique Korean fruit, which are very popular among local young people.

The 2024 financial report shows that as of December 31, 2024, Chabaidao had opened 7, 2, 2, 2, and 1 stores in South Korea, Malaysia, Thailand, Australia, and Hong Kong, China, respectively. This indicates that Chabaidao's overseas expansion is more focused on regions and countries surrounding China.

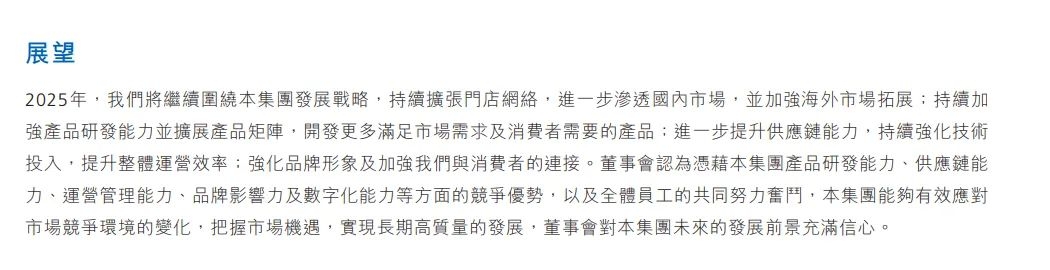

In the company's 2025 outlook, Chabaidao explicitly listed "going global" as the first priority—in 2025, we will continue to focus on the group's development strategy, persistently expand the store network, further penetrate the domestic market, and strengthen overseas market expansion.

Image source: Chabaidao financial report

The "one strategy per location" approach in markets like Malaysia and South Korea has become a key factor in Chabaidao's success. In contrast, another company, Guming, remains more focused on the domestic market and maintains a wait-and-see attitude towards overseas expansion.

From the prospectus information, it can be seen that Guming is a firm anchor in the lower-tier markets. The prospectus shows that as of December 31, 2023, the number of Guming stores in second-tier and lower-tier cities accounted for 79% of its total store count, the highest proportion compared to the other top five mass-made tea drink brands, and this increased to 80% by September 30, 2024.

Throughout the entire prospectus, Guming rarely mentions "going global" and does not even express an intention to enter first-tier cities.

In the latest 2024 annual report, Guming's outlook remains: "We will continue to increase store density in the 17 provinces where we have already established a presence." — As of December 31, 2024, there are still 17 provinces nationwide where we have not established a presence, leaving broad space for our development. We will strategically enter provinces adjacent to those where we have already established a presence.

At the same time, Guming remains relatively cautious about going global. The statement in the annual report is: "We will also continue to evaluate opportunities to enter overseas markets, prioritizing markets with significant growth potential in the made-to-order beverage sector, and will also consider building supply chain infrastructure and expanding our platform to support an overseas store network."

Compared to Mixue Bingcheng's bold strides and Nayuki's Tea's high-profile aggressiveness, brands like Chabaidao and Guming tend to choose a region for deep cultivation, relying on "precision strikes" to stabilize their market position.

Due to some well-known reasons, the entire "going global" circle has faced significant challenges in the past period, and the tea beverage industry is no exception.

The first to bear the brunt is the implementation of new environmental regulations in various countries. Thailand has been continuously advancing its "Roadmap on Plastic Waste Management 2018-2030" in recent years. According to the roadmap, Thailand banned the use of plastic microbeads, oxo-degradable plastics, and other plastic products by the end of 2019, stopped using lightweight plastic bags thinner than 36 microns, plastic straws, foam plastic food containers, plastic cups, etc., by 2022, and aims to achieve 100% plastic waste recycling by 2027. The Malaysian government plans to completely ban businesses from using plastic bags by 2025 at the latest, a measure that also includes all businesses and roadside stalls nationwide. Indonesia plans to completely ban single-use plastic products, including polystyrene for food packaging, plastic straws, plastic utensils, and plastic shopping bags, by the end of 2029.

The selection of various environmentally friendly materials by companies will undoubtedly increase costs. Taking straws as an example, the cost of paper straws and biodegradable straws is higher than that of ordinary plastic straws. One plastic straw costs about 0.01 yuan, one paper straw about 0.03 yuan, and one biodegradable PLA straw about 0.05 yuan. This single item could increase costs by up to five times.

The second is the counterattack from local brands. In Indonesia, the local brand Tehbotol acquired the regional agency rights of a certain Chinese brand, gaining supply chain technology and store management systems, and subsequently launched similar products at prices 20% lower; the Vietnamese local tea drink brand Phuc Long also attempted to use "Vietnamese-style coffee milk tea" to compete against Chinese brands.

According to a Vietnamese businessman, the smartest Vietnamese businessmen are now doing two things: either acting as agents for Chinese brands, or imitating the Chinese model 1:1.

Finally, there is the perennial issue of the supply chain. "The ultimate goal in overseas markets is the dual mastery of the supply chain system and cultural discourse power," wrote a brand CEO in the annual report message.

Zhu Danpeng, a Chinese food industry analyst, also stated that the core of future enterprise competition lies in the completeness of the supply chain. To generate brand effect, scale effect, and fan effect overseas, especially in terms of quality and food safety, the supply chain is indispensable. Therefore, we cannot engage in blind expansion without first establishing a solid supply chain, as expansion is a concrete manifestation of supply chain capability. Without supply chain support, Chinese tea beverage brands cannot rapidly grow large overseas, nor can they achieve refinement and thorough market penetration.

Wanlian Securities analyst Ye Boliang believes that new tea beverage companies face two important challenges when going global: first, raw material supply. Companies need to establish a reliable supply chain system under the seasonal differences and logistical constraints of different countries and regions, while finding a balance between local procurement to reduce costs and maintaining product consistency. Second, cultural background. Overseas consumers have a relatively low awareness of tea culture. Companies still need to effectively promote the market and educate the brand, conveying the unique value and cultural connotations of new tea beverages to cultivate consumers' tea-drinking habits.

On the other hand, although many tea beverage brands are actively embracing the capital market, the attitude of the capital market has begun to polarize.

Nayuki's Tea's stock price has fallen from its IPO price of HK$19.8 per share to the latest closing price of HK$1.12 per share, evaporating over 90%; Chabaidao's IPO price was HK$17.5 per share, and one year later, it is now only HK$9.48 per share.

Other brands have seen significant gains. Mixue Group's stock price has soared since its listing, with its highest market capitalization reaching HK$190 billion; Guming's rise has been even more pronounced, with its market capitalization doubling from HK$30 billion at the time of its IPO to HK$60 billion. Auntea Jenny, which just listed yesterday, opened with a surge of 68%, and closed with a gain of over 40%. During the IPO period, Auntea Jenny was oversubscribed by more than 3,400 times, with subscription amounts exceeding HK$94 billion, setting a record for Hong Kong stock IPO subscriptions this year.

The "Chasing Dreams in Southeast Asia - Research Report on the Overseas Expansion of Freshly Made Beverages" recently released by Ries Strategy Consulting emphasizes that although domestic new tea drink brands appear to have natural competitive advantages when entering Southeast Asia, capturing the Southeast Asian market is not easy. Apart from the varying development paces of the freshly made tea beverage markets across Southeast Asian countries, against the backdrop of regional fragmentation and diverse religious cultures, a "one-size-fits-all" strategy cannot succeed throughout Southeast Asia.

Yang Qianqian, an analyst at Ries Strategy Consulting, believes that within three years, the Southeast Asian tea beverage market will enter a "life-or-death situation," where brands lacking continuous hit product development capabilities will face elimination. The intense competition within China's tea beverage market will inevitably extend to the Southeast Asian market. The freshly made tea beverage industry in Southeast Asia will soon enter a stage where "innovation density determines survival probability."

When the domestic market becomes saturated to the point of no further intensification, going overseas becomes a necessity. However, overseas markets will soon witness a new round of intense competition and rebirth.

Currently, the true game-changer has yet to emerge. The next industry reshuffle might be hidden within the reports of the coming year.